Customers in certain regions may qualify for higher rates on their Growth accounts, and might be eligible to apply for PNC's online savings account, which also comes with a higher annual percentage yield. Convenience is the main appeal of the PNC Virtual Wallet since you can easily get checking and savings accounts packaged with one application and less hassle. The online and mobile money management tools appeal to those who want to track their money and transfer funds without needing to rely on third-party apps or websites. The overdraft protection available with the secondary checking account and savings account offers some peace of mind along with warnings that can help you avoid declined transactions and overdraft fees. While PNC doesn't offer the highest interest rates on its deposit accounts, it does charge low monthly fees, and it also lets you waive those fees not only with a minimum balance but also with minimum direct deposits.

Even PNC's premium accounts allow you to waive fees through direct deposit, a policy most banks don't follow. In addition, the saving and budgeting tools add a way to organize your finances with the Virtual Wallet account package. A few other banks also package checking and savings accounts together, but PNC's Virtual Wallet actually provides tools to help you use the accounts together in a logical way. Despite the benefits, some customers may feel frustrated with the account fees and the inability to open just a savings account with the Virtual Wallet product options available. Unless your account waives it, the monthly service fee can range from $7 to $25 where there are other banks that have fee-free checking and savings accounts that appeal to frugal customers.

Plus, there are ATM fees that you might incur beyond the monthly waivers and allowances. While you can opt just for a Virtual Wallet checking account, you'd need to look into other PNC products simply for savings and miss out on some of the Virtual Wallet benefits in the process. The Reserve account APY is 0.01 percent on balances $1 and higher; the standard APY on the Growth account is 0.01 percent. "Relationship rates" are 0.02 percent APY on balances up to $2,499.99 and 0.03 percent APY on $2,500 and above. To qualify for the relationship rate, you must have at least five PIN or point-of-sale transactions per month using your PNC Visa debit card or PNC credit card, or $500 in qualifying monthly direct deposits.

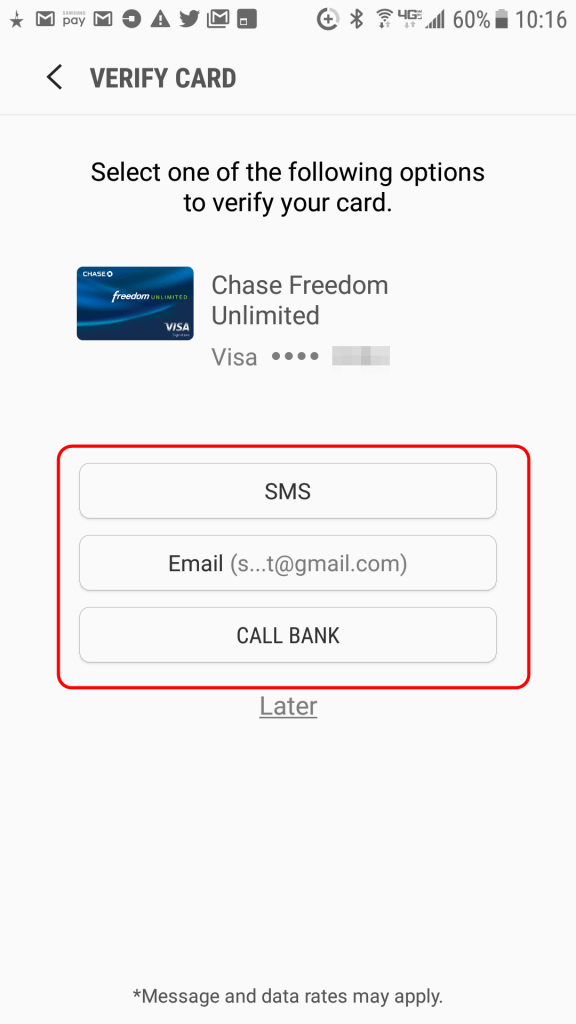

All PNC checking account customers get a PNC Bank Visa Debit Card and the surcharge-free use of thousands of ATMs. There is also reimbursement of some non-PNC ATM fees, free online banking and mobile banking and higher interest rates on savings as you build your balances. With the PNC Mobile app, you can deposit checks, make cardless ATM transactions, find nearby ATMs, check your balances, set up account alerts and more.

To get access to Citibank's virtual credit card services, you have to log in to your account and select enroll. Much like DoNotPay's virtual card, Citibank offers short-term VCC accounts that can be used for single transactions only. If you need a virtual card to use for recurring payments, Citibank might not work for you.Capital OneCapital One provides VCC services through its digital assistant called Eno.

What is amazing about it is that you can install Eno as a web browser plugin that will automatically pop up during check out and ask you if you want to use a new virtual card for the upcoming transaction. Keep in mind that setting a maximum charge limit is not available with Capital One's virtual credit cards. Two out of three accounts within PNC's Virtual Wallet are checking accounts. "Spend" is the primary checking account and is a fairly standard checking account that does not earn interest. There's no minimum deposit requirement to open a Spend account online.

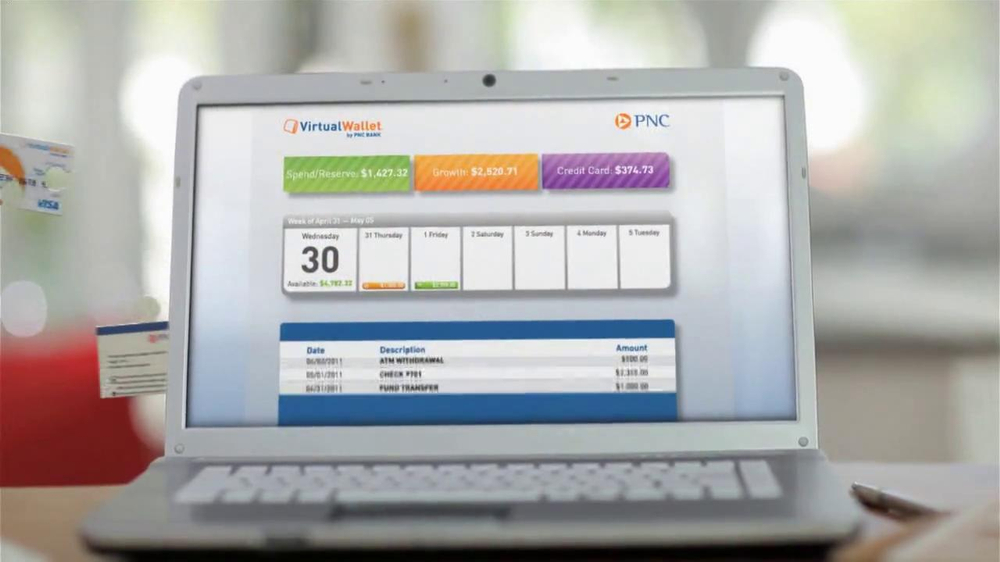

The account also comes with a free debit card and access to PNC's fee-free ATM network. Our unique bank-at-work program includes digital money management tools, financial wellness workshops, benefits & more. You may also earn certain offers and rewards on select banking products and services when you hold a qualifying checking account, and you gain access to the insight and experience of PNC financial specialists. Virtual Wallet combines a Spend function for banking and bill pay, a Reserve account for short-term savings and overdraft protection plus a Growth account. Some of the enhancements include budgeting and smart spending, which enables customers to consolidate their payment methods and create budgets for their spending categories. Customers can also add eligible PNC credit cards to the Virtual Wallet in order to get a complete view on this spending in one place.

The card balance, available credit and monthly spending history will appear together. Via new alerts, customers will keep track of their debit and credit card usage with e-mail and text messages. PNC Bank is the seventh-largest bank in the country by assets.

Depending on their location, customers can earn up to a $300 sign-up bonus with a checking, short-term savings and long-term savings combo called Virtual Wallet. The trio of products — named Spend, Reserve and Growth, respectively — comes with a nice set of online management tools. But the interest rate on short-term savings is low, and it takes effort to avoid monthly fees on the checking account. All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live.

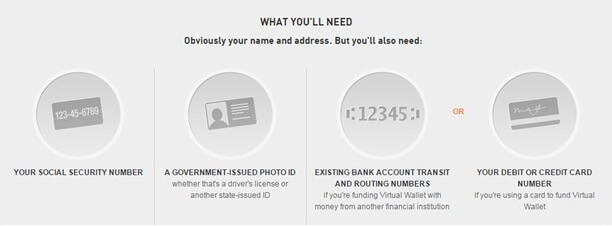

Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account. To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available.

Virtual Wallet is, simply put, the best online banking system I have ever used. I started with online banking in its early days with a third party system called CheckFree that worked through my bank. Banks at that time did not offer what we have come to know as online banking. I evolved to standard online banking software through my bank when it became available but opted for Virtual Wallet when it was first offered. It allows me to track all of my funds, plan on payments in the future knowing what funds will be available at that time. All of my accounts are linked so that if I ever scheduled payments that exceeded available funds in my basic checking account, funds are automatically transferred from one of my other accounts without my intervention.

You can place me in the category of being a very satisfied customer. PNC offers free online and mobile banking with each of their accounts. These services give you access to your funds at your computer or while on-the-go.

You can check balances, pay bills, and transfer money all from your computer, tablet, or smartphone. Virtual Wallet®, a best-in-class bank account and money management solution, is supported by powerful, patented digital tools that help customers plan and track spending. PNC provides these and other deposit, lending, credit card, cash management and investment services to help individuals, families and businesses achieve financial well-being. If you don't opt for the Virtual Wallet package and open just a single savings account, your interest rate will drop from the relationship bonus of 0.06% to the standard 0.01%. As long as you maintain the minimum waiver balance or set up automatic transfers of at least $25 from your checking, you won't be charged a maintenance fee.

Most people won't join PNC just for its interest rates, but the bank's options for savings goals and automatic transfer setup can be useful if you need motivation to save. The PNC Virtual Wallet offers the features of a checking account and savings account rolled into one. It's interest-bearing, comes with ATM access and helps you track your spending through an app. But interest rates top out at 0.06% and monthly fees could eat into your savings.

PNC mentions that the fully-featured packages for Virtual Wallet have tools to help you spend, reserve and grow your money. This involves a primary checking account for daily spending, a secondary checking account as reserve funds and overdraft protection and a long-term savings account for growing your money. However, most Virtual Wallet products offered will give you the option to only get a primary checking account to keep things simple. Even with this option, though, you'd still get the online planning, budgeting and tracking tools. If you're looking into opening a checking or savings account at PNC Bank, you'll find that the Virtual Wallet product appears as the most popular choice for both general consumers and students.

Rather than providing you with just one account, this product comes in different versions where you can get a checking account only or both checking and savings accounts. Virtual Wallet also features tools that can help you set and work toward certain financial goals. Read on to learn more about how PNC Virtual Wallet works, which package options are available and the features, pros and cons involved with this financial product. You can get the monthly service fees waived if you meet the minimum requirements. Each PNC checking account has a minimum account balance required or you will pay a monthly fee.

If you don't meet the minimum, you may be able to have the fee waived by meeting the minimum monthly direct deposit requirements. Eligible markets also have access to PNC's High Yield Savings. This online-only savings account features a more competitive rate currently at 0.40% APY. The account features no minimum opening deposit or ongoing balance and no monthly service charges. Get a $450 welcome bonus when you open your account with qualifying activities. Must open HSBC Premier checking account through offer page by January 5, 2022, and set up qualifying direct deposits into the new account totaling at least $5,000 per month.

Deposit products are offered in the US by HSBC Bank USA, N.A. Member FDIC. PNC offers a full range of regular banking products, including checking and savings accounts, credit cards, loans and more. A popular choice is the PNC Virtual Wallet, which lets you manage your money online across accounts designed for checking, saving and investing. To open a Virtual Wallet account requires a minimum deposit of $25, but you can waive that if you open the account online. Also, there is a monthly service charge of $7 that you can waive by keeping a balance of $500 in your Spend or Reserve accounts, or making $500 in qualifying deposits in a specified time period. You can pair any of the below checking accounts with Virtual Wallet or you can choose a standalone checking account.

The difference between the various tiers is the minimum required balance and/or minimum required automatic deposits to waive the monthly service fee. Overdraft protection is drawn from the Reserve and Growth savings accounts and there is no fee to transfer the money. PNC spending and budgeting tools help you track and manage your money. You can set up a budget, schedule bill payments, get alerts when your account is at risk of being overdrawn, set up automatic savings, and more. PNC Bank makes it easy for Penn State students to keep track of their money. Like Virtual Wallet Student®, which provides checking and savings options you can manage online - or from the palm of your hand.1You can even use your id+ card as your ATM card when you link it to your PNC account!

PNC Bank also offers technologies both online and in the mobile app to help you budget and spend wisely, to know when your balance is low and to stick to your savings goals. For example, Money Bar®displays the money you've set aside for bills and what's left over / free to spend. When the money in your Spend account is low, Danger DaysSMappear on your calendar so that you can adjust your spending or transfer money from your savings. Traditional brick-and-mortar savings accounts can be a simple but stable solution for keeping your money secure. They mostly all earn the same interest rate, come with minimum balance requirements and monthly fees.

Account holders also have access to their thousands of in-person branches and ATMs, one of the most common reasons why people opt for big banks. Similar to Citi's "banking packages", PNC offers combo products that pair checking, short and long-term savings accounts together under "Spend, Reserve and Growth" virtual wallets. A single fee covers the trio of accounts and, like most linked accounts, it's easy to transfer money between the three (plus offers 2-layers of fee-free overdraft protection). You can activate special offers from retailers using online banking or Virtual Wallet, then use your PNC Bank debit card to make the qualifying purchase. The resulting cash back, usually 2 to 5 percent, will appear in your checking account automatically.

You need at least $500 in your account to avoid fees if you don't use direct deposit on even the most basic PNC checking account. This isn't good for those who keep low monthly balances in their checking accounts. When you use online and mobile banking, you can access your online account statements, transfer funds to PNC and non-PNC accounts, and download your transactions directly to Quicken or QuickBooks. You can also transfer money to family or friends easily with PopMoney.

All you need is your recipient's email address or phone number to send them money right from your PNC account. PNC also offers a Premiere Money Market Account, available in select markets. Rates range from 0.02% to 0.06% APY, depending on your balance and whether you qualify for relationship rates. The money market account features unlimited deposits and a PNC debit card.

If you're a college student, PNC won't charge you any monthly account fees on Virtual Wallet as long as you are enrolled. You should also look at PNC if your parents bank there, since transfers are faster and cheaper between accounts held within the same bank. And if your school is partnered with PNC, there may be classes in financial education and money management provided jointly by the bank and your school, which may give you a good introduction to personal finance. PNC's account management tools are another way to help you learn to handle your own money. Credit unions are another option, as long as you meet the membership requirements.

Membership requirements are pretty lenient at some credit unions. Bankrate's list of the best credit unions ranks them based on selection of products, APY offerings, mobile features, and associated fees. You can also find high yield checking accounts with APYs of 1 percent and higher at certain banks if you maintain a set minimum balance and meet the requirements for that APY.

PNC also makes this product accessible to customers with different versions that can fit their needs. The ATM fee reimbursements included with all Virtual Wallet products along with the free wire transfers for certain products can make banking more affordable to more people. Although it has "virtual" in the name, your bank accounts are still regular ones where you can deposit and withdraw money at ATMs and bank branches.

This differs from an online-only bank account you'd find through places like Ally Bank. While you can get a stand-alone checking or savings account, there's no information online about how to open one. You'll want to spend some time doing your homework before opening an account. Consider combing through the details on the website or speaking to a customer rep to get your questions answered. If you find PNC's Virtual Wallet products appealing and meet the criteria to get the monthly maintenance fee dropped, it could be worth your while to open an account. Also, if you prefer to bank with a large financial institution with a host of offerings, it might be right for you.

PNC offers many options for checking and savings accounts, but even more robust options for those who want budgeting tools. The Virtual Wallet accounts are unique in their offerings and rather affordable compared to what other banks charge. If you live in a state where PNCs are located, it can be a great way to help you set up a budget, track your finances, and reach your savings goals. PNC is making it easier for you to keep track of your money at Duquesne University.

You'll find a PNC branch in the Cooper Building on Fifth Avenue and 8 PNC ATMs on campus. And with PNC Virtual Wallet Student®, managing your money is easier too. As a Duquesne student and PNC customer, you can link your bank account to your DU Card and use it as an ATM card. You can even request a PNC Bank Visa ® debit card designed just for Duquesne. Whether you receive offers may depend on using your PNC Visa Card, or where you use your PNC Visa Card to make purchases. Virtual Wallet Student has no minimum balance requirement or monthly service charge for active students for six years from the date of account opening.

These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.